Money Smarts Blog

How To Retire Early Ultimate Guide

Mar 7, 2020 || Elizabeth VanCamp

Preparing for retirement is super important, but far too few Americans are adequately prepared for their post-employment years. Even those who have begun saving for retirement may not be doing enough yet.

You might be one of those people. But you don’t need to panic.

While it’s best to start saving for retirement as early (and aggressively) as possible, various factors make this difficult, if not impossible, for many people.

The silver lining is that you can always start saving, and once you’ve started working toward your retirement goal, there are some easy steps you can take to increase your retirement funds, and maybe even catch up to where you’d like to be.

Before you turn 30

Save a little bit each month

If you haven’t already started saving for retirement, open a 401(k) or IRA as soon as possible and start contributing to it each month. Your contributions don’t have to be massive—just add what you can afford.

You may be thinking, "Why? I don't even know what 6 months from now holds, let alone when I'm going to retire." While that's true, it's smart to learn how to juggle - not literally - but juggle your current debts, short-term financial goals, while also protecting yourself for the future.

Even though thinking about adding “saving for retirement” to my to-do list makes me cringe, it doesn’t have to be a big, scary thing.

You’re much better off putting something into your 401(k) or IRA in your 20s than putting in nothing. Look at your budget and see if you can spare 5-10% of your monthly income. As you pay off debts or increase your income in the future, remember to bump that percentage up accordingly to help increase your total retirement funds.

Automate your savings

You might be like a lot of folks and not be great at remembering to put money aside for this important time in your life before spending it on non-essentials (like coffee, online shopping, weekend activities, etc.). If this is true for you, it’s time to automate your savings.

If you contribute to a 401(k) through your work, the deposit will come out of your payment automatically, but you can also set up automatic contributions to your IRA (or a savings account so you can set up an emergency fund). Automating your savings will help you reach your savings and retirement goals faster, and will help you avoid spending extra cash on things you don’t need.

Be aggressive with your investments

If you’re a Millennial, chances are you’re a bit conservative with your investments and may be a little freaked out by the stock market. It’s a no-brainer, considering Millennials grew up through the Great Recession, have weathered the COVID-10 pandemic and have record amounts of student loan debt. But don’t let any fear of the stock market or investing aggressively stop you from reaching your retirement goals quicker.

Choose the more aggressive investment options for your 401(k) and/or IRA, and invest more in stocks than in bonds and other conservative investments. You have time on your side, so your portfolio will recover from any market fluctuations by the time you hit 65, and chances are pretty high that your average return will be well worth the risk.

Don’t cash out your retirement accounts

Job hopping, or moving from one job to another relatively quickly, is common when people are in their 20s, especially for millennials and especially in today's job climate.

When moving from one job to another, it can be really tempting to cash out your retirement fund and use it for things like rent. But cashing it out only helps you for a short time, and rolling it over into a retirement fund at your new job (or into an IRA you open on your own) will pay out big time later in life.

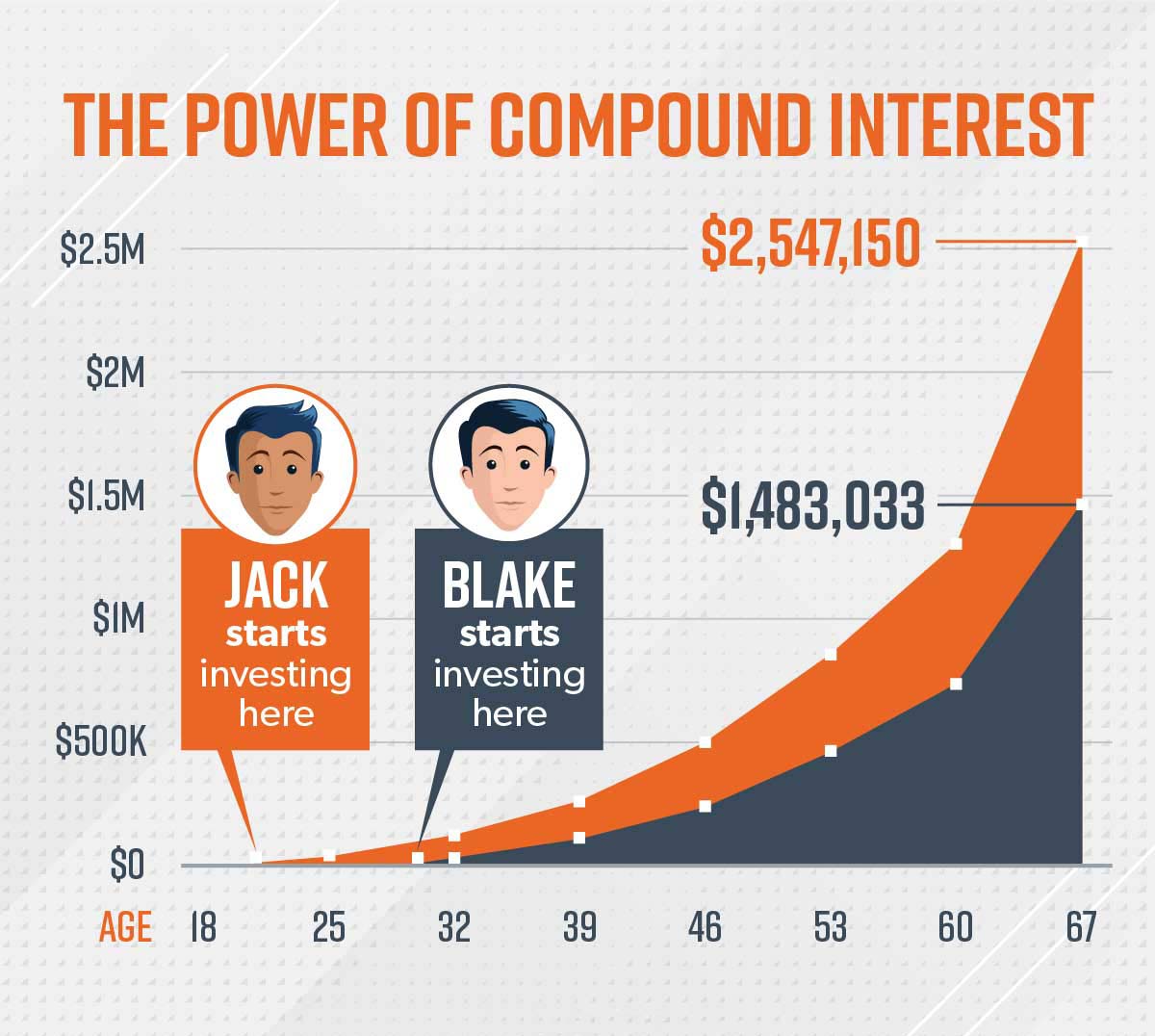

The longer you allow your contributions to compound, the more you’ll make off your investments, so holding onto your retirement contributions from work will help you increase your overall retirement savings.

Check out this example of compound interest from Dave Ramsey. Jack started investing in his early 20s, while Blake started at 30. At age 67, Jack’s investment has grown to $2,547,150, and Blake’s has grown to $1,483,033! Nine years made a difference of over one million dollars.

Image property of ramseysolutions.com

During your 30s

Continuing taking some risks

Just because you’re not a 20-something anymore, doesn’t mean you can’t take risks with your investments. You still have 30 plus years until retirement so don’t shy away from risk when the return could be so great over the years.

If you’ve been more conservative with your investments so far, start choosing more aggressive options or move the majority of your investments to stocks to increase your portfolio. If you aren’t sure where to start, ask your favorite financial consultant for advice and help with this.

Start contributing to your 401(k) and/or an IRA

Not everyone has access to a 401(k) at their job, but a recent Census revealed that 79 percent of Americans have access to one at their work. So, if you have the option to contribute to a 401(k), especially if your employer matches contributions, open your account as soon as possible.

But, if you don’t have a 401(k) option at work, open an IRA and choose the most aggressive investment option you feel comfortable with. You can only contribute up to $6,000 per year to an IRA so, while that’s a good start, it’d be a good idea to chat with a financial advisor about additional investment options if you think you’ll max out your IRA contributions this year.

You also have the option of contributing to a 401(k) and an IRA. If your employer doesn’t match 401(k) contributions, work on maxing out your IRA then start contributing to your 401(k). Especially if you didn’t utilize one or the other during your twenties, this is a great way to boost your savings and diversify your retirement portfolio.

Make a plan for your retirement savings when switching jobs

You may not job hop as much as you did during your twenties, but your thirties might still bring about some cool new job opportunities. When you move onto a new job, be mindful of your retirement savings.

Your 401(k) can be rolled over into your new job’s 401(k) plan so your savings won’t miss a beat, but you can also roll your savings into an IRA so you can invest it how you’d like to. Whatever you do, don’t cash it out! You’ll be charged income tax plus a 10 percent penalty tax if you cash out your retirement before you turn 59 ½ years old—yikes!

After you turn the BIG 4-0

Start investing in stocks

In addition to continuing to contribute to your 401(k) and/or IRA, you should definitely consider investing in stock after your 40th birthday. Retirement can still seem really far away when you’re in your forties and fifties, but that doesn’t mean you should be complacent about increasing your overall savings. Stocks can help you stay on top of your goals.

For instance, if you contribute $250 per month with a five percent return for 25 years, you can expect around $150,000 extra for your retirement nest egg. The more you can contribute, the higher your return will be (for instance, contributing $400 each month bumps your return to $240,000 after 25 years), so determine how much you can feasibly put into the stock market and watch your retirement fund grow.

Find the right mix for your investments

Although your instinct in your forties might be to start playing it safe with your investments, you can (and should) still take some risks, but it’s okay to start investing in more conservative ways, too.

Diversify your investments between your 401(k), an IRA, stocks, and bonds, and determine how aggressively or conservatively you’d like to invest going forward. Ellen Rinaldi, Vanguard’s former head of retirement agenda, suggests that after you turn 40, you should keep around 80 percent of your retirement investments in stocks and put the rest in investments like bonds.

It can be difficult to determine the perfect investment mix for you, so don’t be afraid to consult with a professional. You can really increase your retirement savings throughout your forties and fifties if you find the right mix of investments, but that’s easier said than done for the average person. Luckily, financial consultants know their stuff and can help you reach your goals for a happy and financially sound retirement.

Start increasing your retirement savings, already!

Kudos to you for thinking about your future! No matter how old you are or how long you’ve been working for, it’s never too late to start saving for retirement or increasing your overall investment portfolio. And with so many options for diversifying and increasing your savings potential, your goals for your golden years are more reachable than ever!

How To Retire Early Ultimate Guide

Mar 7, 2020 || Elizabeth VanCamp

Preparing for retirement is super important, but far too few Americans are adequately prepared for their post-employment years. Even those who have begun saving for retirement may not be doing enough yet.

You might be one of those people. But you don’t need to panic.

While it’s best to start saving for retirement as early (and aggressively) as possible, various factors make this difficult, if not impossible, for many people.

The silver lining is that you can always start saving, and once you’ve started working toward your retirement goal, there are some easy steps you can take to increase your retirement funds, and maybe even catch up to where you’d like to be.

Before you turn 30

Save a little bit each month

If you haven’t already started saving for retirement, open a 401(k) or IRA as soon as possible and start contributing to it each month. Your contributions don’t have to be massive—just add what you can afford.

You may be thinking, "Why? I don't even know what 6 months from now holds, let alone when I'm going to retire." While that's true, it's smart to learn how to juggle - not literally - but juggle your current debts, short-term financial goals, while also protecting yourself for the future.

Even though thinking about adding “saving for retirement” to my to-do list makes me cringe, it doesn’t have to be a big, scary thing.

You’re much better off putting something into your 401(k) or IRA in your 20s than putting in nothing. Look at your budget and see if you can spare 5-10% of your monthly income. As you pay off debts or increase your income in the future, remember to bump that percentage up accordingly to help increase your total retirement funds.

Automate your savings

You might be like a lot of folks and not be great at remembering to put money aside for this important time in your life before spending it on non-essentials (like coffee, online shopping, weekend activities, etc.). If this is true for you, it’s time to automate your savings.

If you contribute to a 401(k) through your work, the deposit will come out of your payment automatically, but you can also set up automatic contributions to your IRA (or a savings account so you can set up an emergency fund). Automating your savings will help you reach your savings and retirement goals faster, and will help you avoid spending extra cash on things you don’t need.

Be aggressive with your investments

If you’re a Millennial, chances are you’re a bit conservative with your investments and may be a little freaked out by the stock market. It’s a no-brainer, considering Millennials grew up through the Great Recession, have weathered the COVID-10 pandemic and have record amounts of student loan debt. But don’t let any fear of the stock market or investing aggressively stop you from reaching your retirement goals quicker.

Choose the more aggressive investment options for your 401(k) and/or IRA, and invest more in stocks than in bonds and other conservative investments. You have time on your side, so your portfolio will recover from any market fluctuations by the time you hit 65, and chances are pretty high that your average return will be well worth the risk.

Don’t cash out your retirement accounts

Job hopping, or moving from one job to another relatively quickly, is common when people are in their 20s, especially for millennials and especially in today's job climate.

When moving from one job to another, it can be really tempting to cash out your retirement fund and use it for things like rent. But cashing it out only helps you for a short time, and rolling it over into a retirement fund at your new job (or into an IRA you open on your own) will pay out big time later in life.

The longer you allow your contributions to compound, the more you’ll make off your investments, so holding onto your retirement contributions from work will help you increase your overall retirement savings.

Check out this example of compound interest from Dave Ramsey. Jack started investing in his early 20s, while Blake started at 30. At age 67, Jack’s investment has grown to $2,547,150, and Blake’s has grown to $1,483,033! Nine years made a difference of over one million dollars.

Image property of ramseysolutions.com

During your 30s

Continuing taking some risks

Just because you’re not a 20-something anymore, doesn’t mean you can’t take risks with your investments. You still have 30 plus years until retirement so don’t shy away from risk when the return could be so great over the years.

If you’ve been more conservative with your investments so far, start choosing more aggressive options or move the majority of your investments to stocks to increase your portfolio. If you aren’t sure where to start, ask your favorite financial consultant for advice and help with this.

Start contributing to your 401(k) and/or an IRA

Not everyone has access to a 401(k) at their job, but a recent Census revealed that 79 percent of Americans have access to one at their work. So, if you have the option to contribute to a 401(k), especially if your employer matches contributions, open your account as soon as possible.

But, if you don’t have a 401(k) option at work, open an IRA and choose the most aggressive investment option you feel comfortable with. You can only contribute up to $6,000 per year to an IRA so, while that’s a good start, it’d be a good idea to chat with a financial advisor about additional investment options if you think you’ll max out your IRA contributions this year.

You also have the option of contributing to a 401(k) and an IRA. If your employer doesn’t match 401(k) contributions, work on maxing out your IRA then start contributing to your 401(k). Especially if you didn’t utilize one or the other during your twenties, this is a great way to boost your savings and diversify your retirement portfolio.

Make a plan for your retirement savings when switching jobs

You may not job hop as much as you did during your twenties, but your thirties might still bring about some cool new job opportunities. When you move onto a new job, be mindful of your retirement savings.

Your 401(k) can be rolled over into your new job’s 401(k) plan so your savings won’t miss a beat, but you can also roll your savings into an IRA so you can invest it how you’d like to. Whatever you do, don’t cash it out! You’ll be charged income tax plus a 10 percent penalty tax if you cash out your retirement before you turn 59 ½ years old—yikes!

After you turn the BIG 4-0

Start investing in stocks

In addition to continuing to contribute to your 401(k) and/or IRA, you should definitely consider investing in stock after your 40th birthday. Retirement can still seem really far away when you’re in your forties and fifties, but that doesn’t mean you should be complacent about increasing your overall savings. Stocks can help you stay on top of your goals.

For instance, if you contribute $250 per month with a five percent return for 25 years, you can expect around $150,000 extra for your retirement nest egg. The more you can contribute, the higher your return will be (for instance, contributing $400 each month bumps your return to $240,000 after 25 years), so determine how much you can feasibly put into the stock market and watch your retirement fund grow.

Find the right mix for your investments

Although your instinct in your forties might be to start playing it safe with your investments, you can (and should) still take some risks, but it’s okay to start investing in more conservative ways, too.

Diversify your investments between your 401(k), an IRA, stocks, and bonds, and determine how aggressively or conservatively you’d like to invest going forward. Ellen Rinaldi, Vanguard’s former head of retirement agenda, suggests that after you turn 40, you should keep around 80 percent of your retirement investments in stocks and put the rest in investments like bonds.

It can be difficult to determine the perfect investment mix for you, so don’t be afraid to consult with a professional. You can really increase your retirement savings throughout your forties and fifties if you find the right mix of investments, but that’s easier said than done for the average person. Luckily, financial consultants know their stuff and can help you reach your goals for a happy and financially sound retirement.

Start increasing your retirement savings, already!

Kudos to you for thinking about your future! No matter how old you are or how long you’ve been working for, it’s never too late to start saving for retirement or increasing your overall investment portfolio. And with so many options for diversifying and increasing your savings potential, your goals for your golden years are more reachable than ever!